- Zuber Letter

- Posts

- How to make money with real estate today

How to make money with real estate today

This past week, I spoke with Adrian Hernandez about how now is actually one of the best times to buy in over a decade—if you know what you’re doing

Today’s Zuber Letter is brought to you by Stessa!

Track Every Dollar with Stessa—Effortlessly

Managing rental property finances doesn’t have to be a headache. With Stessa, real estate investors can simplify accounting, automate transaction tracking, and stay organized—all in one powerful, easy-to-use platform. Link your bank accounts, property managers, and financial institutions for a clear, accurate financial picture across your entire portfolio.

Stessa also makes bookkeeping stress-free. Track income and expenses by property or portfolio, scan and retrieve receipts on the go, and ensure every transaction is categorized to maximize your deductions. Whether you're managing a portfolio locally or spread out across the country, Stessa keeps you in control from virtually anywhere.

📹 Watch the Demo and see how Stessa can streamline your rental property finances.

✅ Sign Up for Free — Your transactions. Your deductions. Simplified.

The simple ways to make money in real estate today

This week, I sat down with Adrian Hernandez to talk about a question I’m hearing constantly:

Can you still make money in real estate today?

Yes. In fact, I’d argue that now is one of the best times to buy that we’ve seen in over a decade—if you know what you’re doing.

Let’s walk through a few simple, effective ways to make money in today’s real estate market. These are the exact strategies I’m using right now—and you can too.

1. Look for the flood of inventory, not the fear

Realtor.com just reported that Las Vegas active listings are up 77% year-over-year. Most people read that and panic. I see opportunity. This is the first true buyer’s market I’ve seen since 2012.

More listings. More price cuts. More negotiation room. That’s what a buyer’s market gives you.

If your strategy is One Rental at a Time like mine, then more inventory and less competition is exactly what you want.

2. Write offers—lots of them

Want a deal? You’ve got to make offers. Not one. Not five. Dozens.

If something is listed at $200,000 and needs $50,000 in work, offer $120,000. You probably won’t get it. But you’ll learn something. And if you make enough offers, one will hit.

I don’t fall in love with a property. I fall in love with the numbers. That gives me the leverage and discipline to walk away—and the power to land great deals when others hesitate.

3. Use creative financing to unlock opportunities

This is the time to get creative. I’m talking seller financing, subject-to, second position financing. These are tools that let you structure better deals, especially when interest rates are high.

Thanks to PropertyRadar, I can instantly see a seller’s equity position and skip the ones who couldn’t say yes even if they wanted to.

I’m focused on finding sellers with enough equity to accept terms like 50/40/10. That’s 50 percent seller carry first, 40 percent second, and 10 percent down. You can’t make these deals happen with every seller—but when they work, they’re powerful.

4. Work with investor-friendly agents—or train yours

If you’re working with an agent who’s nervous about writing low offers, get a new agent.

You need someone who says, “Let’s write 15 offers today and see what sticks.” If you’re a real estate agent, you need to lead your clients with this same energy. This market rewards activity, not perfection.

What you can’t do is wait around for your dream deal. Write the offer. Learn from the response. Repeat.

5. Short-term rentals and ADUs are back on the table

Two years ago, short-term rentals were oversaturated. Everyone was piling in and I wanted no part of it. But now? A lot of soft hands have been flushed out, and regulation has brought some clarity.

There’s opportunity again—especially in strong locations with views, proximity to water, or vacation appeal.

And if you’re in a market like California or Oregon, don’t overlook ADUs. Adding an accessory dwelling unit to an existing lot can create incredible cash flow and boost your property value.

Derek, one of our community members, is building ADUs for around $90,000 and refinancing out over $130,000 once leased. That’s the BRRRR strategy turned up a notch.

6. Agents and loan officers—hold the line

I feel for real estate agents and mortgage brokers. It’s been a brutal stretch. But I truly believe August will be the bottom for transactions.

From there, it won’t snap back fast, but it will start to turn. If you’ve made it this far, the next few years will feel a lot better.

But survival isn’t enough. You need to skill up. Start focusing on finding deals for investors. Learn creative financing. Get out of the old “tour ten homes, write one offer” mindset.

Start playing offense.

Big Picture:

There are plenty of ways to make money in real estate right now. But they all require the same thing: action.

This isn’t the time to sit on your hands waiting for rates to drop or for some perfect deal to appear. It’s time to build your buy box, write offers, follow up, and do the work.

Most people are sitting on the sidelines. If you’re willing to be active, strategic, and persistent—you’re going to walk into equity, secure great financing terms, and build long-term wealth while others wait.

The best deals always come to those who are willing to ask for them.

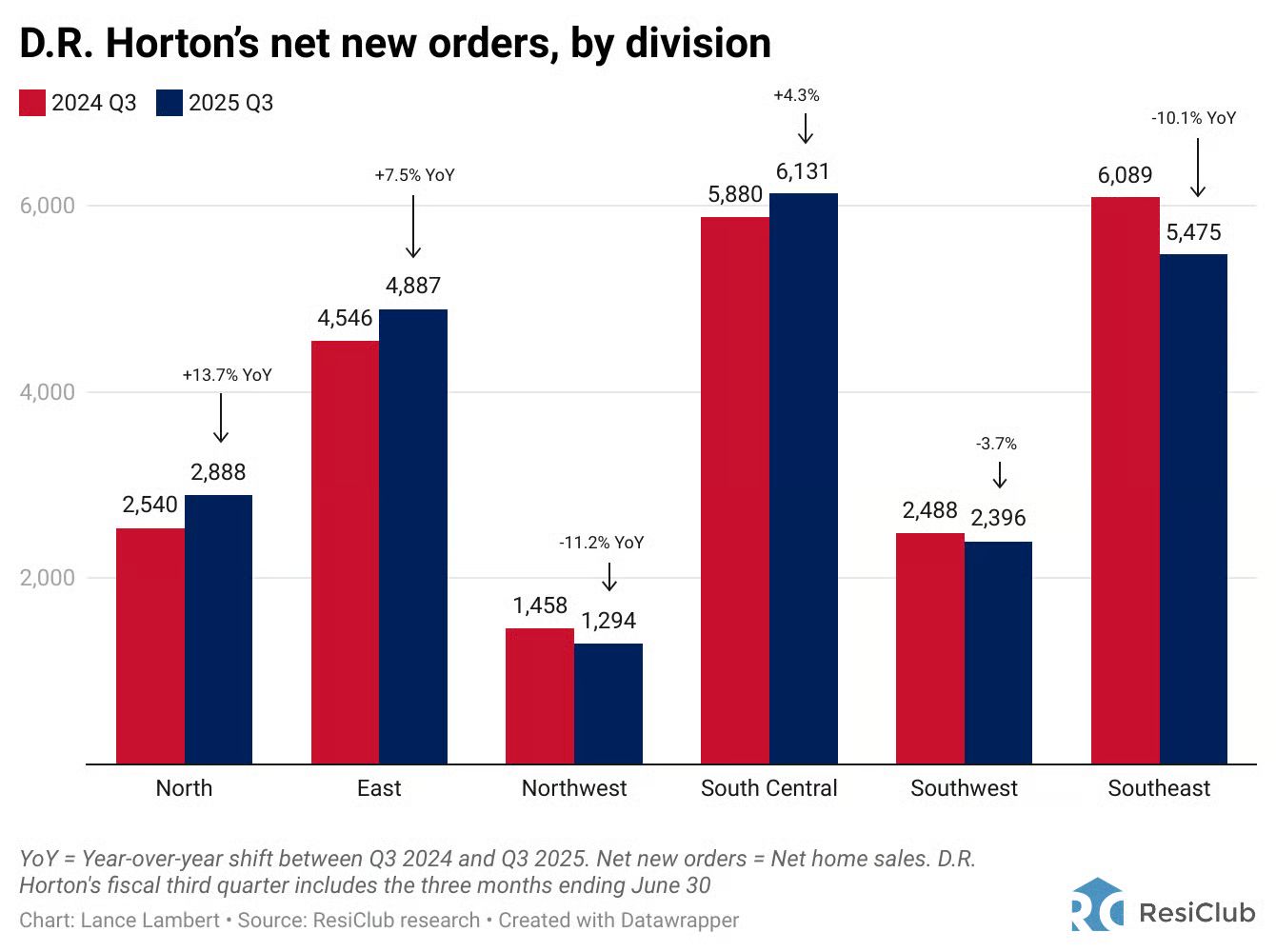

ResiClub chart of the week:

Last week, ResiClub’s Lance Lambert broke down the top-line findings from D.R. Horton’s latest earnings report.

He highlighted that D.R. Horton’s Southeast division—which spans Alabama, Florida, Louisiana, and Mississippi—saw a 10.1% year-over-year decline in net orders in Q3 2025, even as national orders held steady.

During the July 22 earnings call, COO Michael Murray pointedly noted that Florida remains the softest market within the Southeast, while other regions continue to perform well, helped by tight inventory and lot supply.

With the Southeast division representing 24% of D.R. Horton’s total net orders, softness in Florida remains a meaningful drag on the builder’s overall results, ResiClub reported.

Want to advertise your business on The Zuber Letter? Email [email protected]