- Zuber Letter

- Posts

- The 3 real estate mistakes you need to stop making right now

The 3 real estate mistakes you need to stop making right now

This month, I spoke with Casey Franchini about the biggest red flags real estate investors should be looking out for—often within the first 60 seconds of walking a property.

Today’s Zuber Letter is brought to you by Stessa!

Track Every Dollar with Stessa—Effortlessly

Managing rental property finances doesn’t have to be a headache. With Stessa, real estate investors can simplify accounting, automate transaction tracking, and stay organized—all in one powerful, easy-to-use platform. Link your bank accounts, property managers, and financial institutions for a clear, accurate financial picture across your entire portfolio.

Stessa also makes bookkeeping stress-free. Track income and expenses by property or portfolio, scan and retrieve receipts on the go, and ensure every transaction is categorized to maximize your deductions. Whether you're managing a portfolio locally or spread out across the country, Stessa keeps you in control from virtually anywhere.

📹 Watch the Demo and see how Stessa can streamline your rental property finances.

✅ Sign Up for Free — Your transactions. Your deductions. Simplified.

Avoid these 3 mistakes next time you are buying a property

I have walked through hundreds of properties—and bought dozens of them. But you’d be shocked how many investors (especially new ones) walk right into money pits because they miss what’s hiding in plain sight.

That’s why this past month, I spoke with Casey Franchini about the top 3 mistakes we see investors make. These are the things that lead to expensive surprises down the line. They are also the things you can often spot in the first 60 seconds, before you make an offer, before you waste inspection money, and before you risk your earnest deposit.

1. Ignoring big red flags outside the house

Before we even step inside a property, you should be looking at:

Slope and drainage: Is water pooling near the foundation? Is the backyard sloping toward the house? That’s a recipe for flooding—and thousands in foundation damage.

Trees: Large trees near the house might look nice… until a storm hits. Roots can crack foundations, limbs can puncture roofs, and full tree removal can cost $3,500 to $ 7,000.

Windows: They might look fine, but are they functional? Broken springs, warped tracks, and painted-shut panes are code violations and serious hazards. Replacing 17 windows at $500 each? That’s a $8,500 budget hit.

If you’re not checking these things immediately, you’re walking into risk blind.

2. Skipping the stuff that doesn’t “add value” but kills your returns

Here’s a harsh truth: Some of the most expensive repairs won’t boost your ARV or your rent. But if you miss them, they’ll crush your cash flow.

Always check:

Cracks and floors: Look at corners, tile seams, and garage floors. Step cracks in brick or large tile cracks usually mean foundation issues. Budget $5K–$15K.

Subfloors: Jump around in the bathroom. If it’s spongy, there’s likely water damage below.

Main drain lines: Flush all toilets. Run all sinks. Check for slow drainage or gurgling. You don’t want to learn after tenants move in that your sewer line is cracked. Fixes can run $8,000 to $20,000 or more and could involve digging up driveways or re-plumbing kitchens.

Smart investors do a mini-inspection on the spot—and always budget for things that won’t increase rent but are non-negotiable.

3. Overlooking “cosmetic cover-ups” and costly finish decisions

The worst flippers focus on the pretty stuff—paint, flooring, light fixtures—while skipping the expensive-but-essential guts of the home. That’s where the traps lie.

Fresh paint in just one room? The seller is probably hiding something. Check walls and ceilings for cracks underneath.

Heavily textured walls/ceilings? Some investors don’t mind. We do. It signals bad taste or cheap renovations—and smoothing it out later is time-consuming and expensive.

Kitchens: Don’t rip out cabinets just because they’re ugly. If the boxes are solid, you can save thousands by refacing or repainting them instead of replacing them.

Breaker panels: Always open them. If it’s outdated or undersized, it’s a fire risk—and an upgrade you have to make, even if it doesn’t boost rent.

Big picture: The best investors get ahead of the issues. Real estate investing isn’t about writing the prettiest offer—it’s about seeing the whole picture and avoiding expensive surprises.

We’ve made these mistakes so you don’t have to. You don’t need to wait for inspection day to learn if a house is a no-go. If you spend 5–10 minutes outside, inside, and in the garage—checking what we just listed—you can dodge 90% of disasters before you even make an offer.

ResiClub chart of the week:

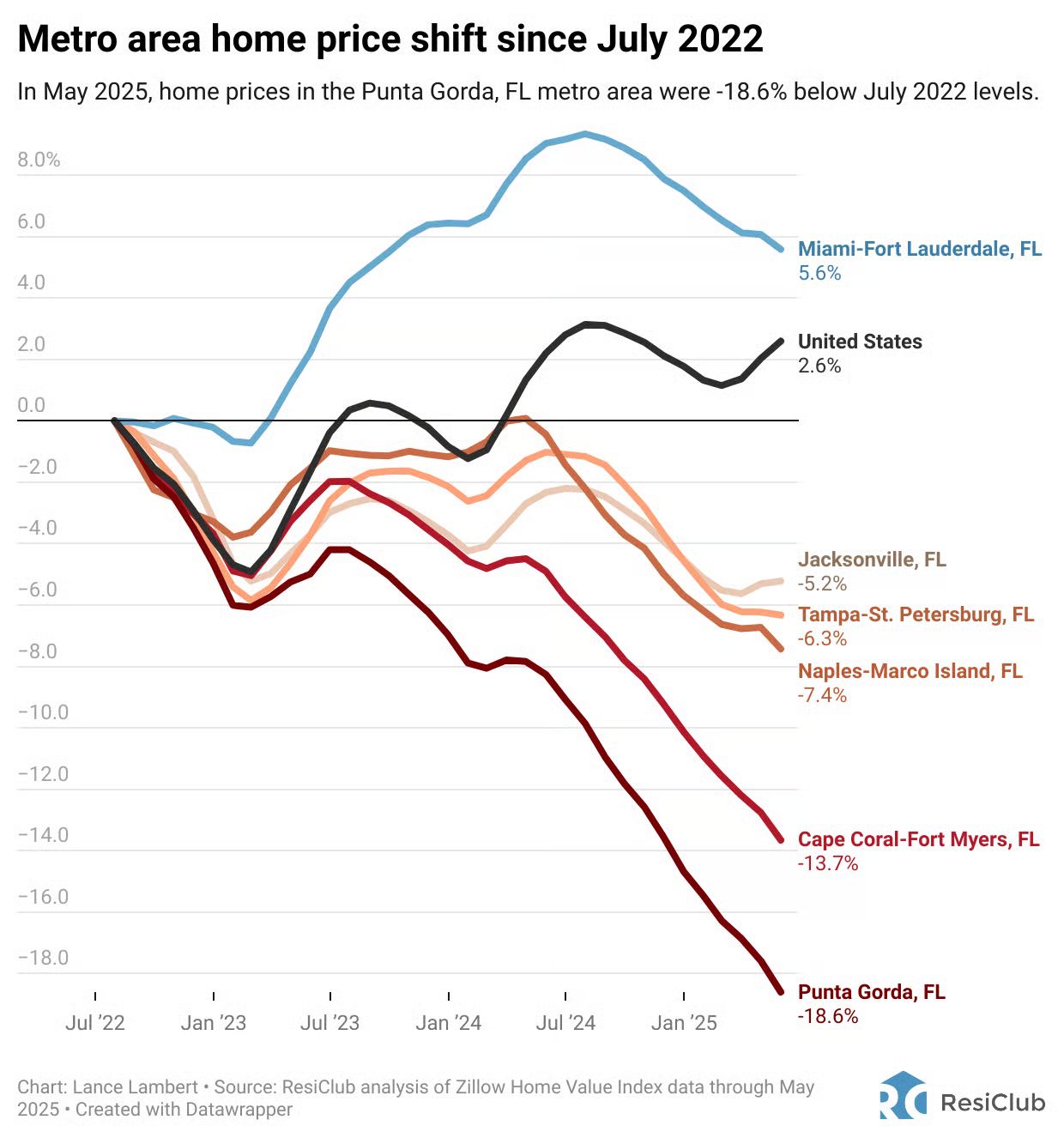

Earlier this month, ResiClub’s Lance Lambert highlighted how home prices in Southwest Florida—especially in markets like Punta Gorda and Cape Coral—continue to fall.

For example, in June 2022, a home in Punta Gorda, FL, sold for $985,000—just before the market peaked. Listed in April 2025 for $1.15 million, the price was cut six times before going pending at $899,000.

Since peaking in 2022, home prices in Punta Gorda are down 18.6%, with condo values falling even faster than single-family homes. Slowing migration, insurance shocks, hurricane damage, stricter condo regulations, and new construction supply elasticity have all shifted market power to buyers.

“Southwest Florida is the weakest regional chunk of the U.S. housing market,” Lambert wrote. “Heading forward, one big question is have home prices fallen enough in markets like Punta Gorda and Cape Coral to get the attention of homebuyers, mom-and-pop single-family investors, and single-family acquisition capital?”

Want to advertise your business on The Zuber Letter? Email [email protected]